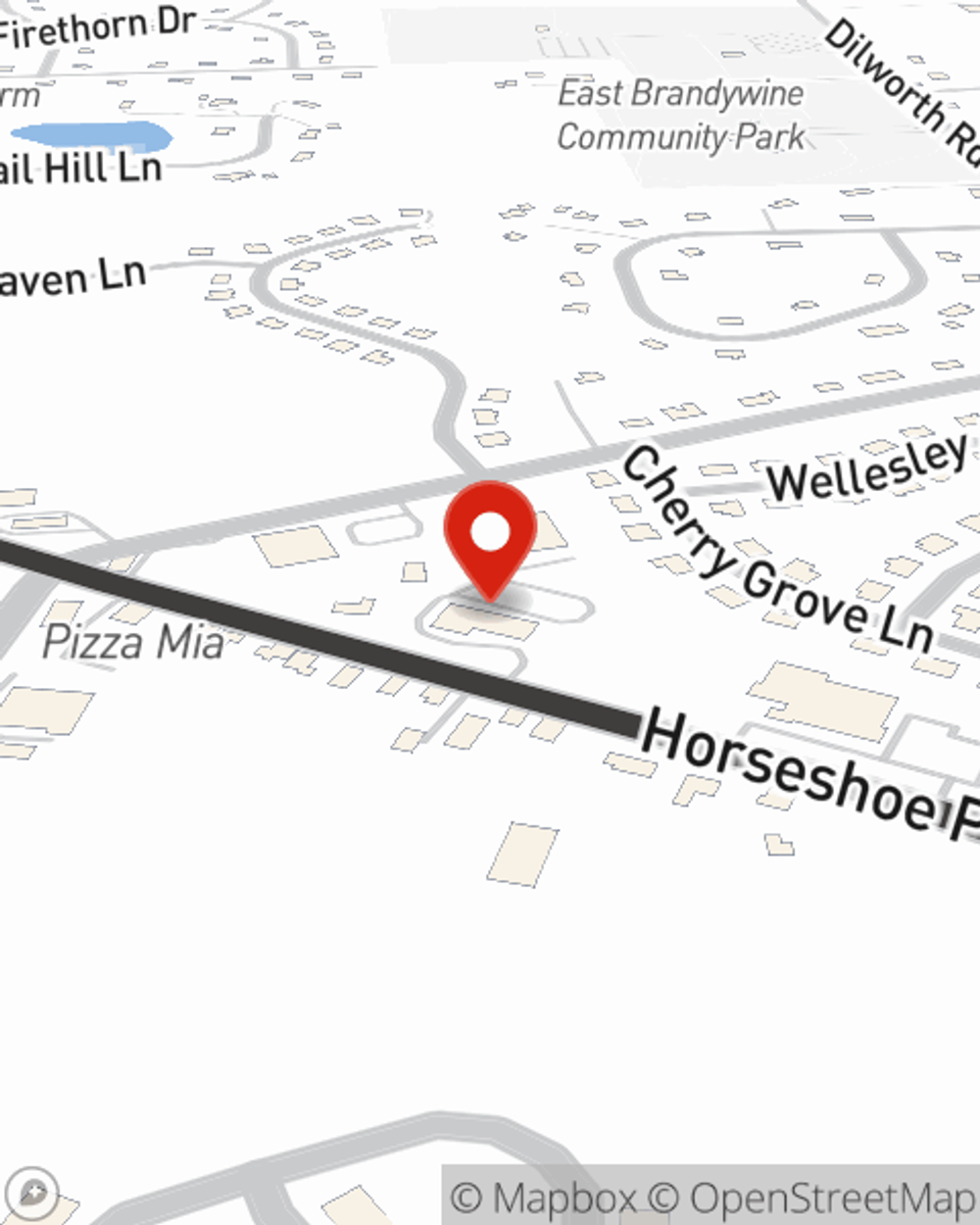

Business Insurance in and around Downingtown

One of Downingtown’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

This Coverage Is Worth It.

Being a business owner is about more than making a profit. It’s a lifestyle and a way of life. It's a commitment to a bright future for you and for everyone you care for. Because you give every effort to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with worker's compensation for your employees, extra liability coverage and business continuity plans.

One of Downingtown’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Customizable Coverage For Your Business

At State Farm, apply for the great coverage you may need for your business, whether it's an art school, a book store or an insurance agency. Agent Kim Nuelle is also a business owner and understands what you need. Not only that, but customizing policy options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage comes out on top.

Call Kim Nuelle today, and let's get down to business.

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Kim Nuelle

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.